By Meng Cheong & Albert Mu

Whether you are a consumer or represent a small business, or deal with consumers or small businesses, it is important to bear in mind that certain terms contained in the standard form contract to which you are a party can potentially be deemed unfair by a court under Section 23 of the Australian Consumer Law (‘ACL’).

One consequence of a term being held as unfair under the ACL is that the term is void, which means it cannot be enforced by a party. A court is empowered by Section 224 of the ACL to impose substantial fines on a person (including a company) who tries to rely on an unfair term within a standard-form consumer contract or small business contract, or enters into such types of contracts that contain an unfair term proposed by that person. Such fines are payable ‘to the Commonwealth, State or Territory, as the case may be’.

The ACL now defines a small business contract as one that ‘is for a supply of goods or services, or a sale or grant of an interest in land’ and, in addition, includes a party that is employing fewer than 100 people (when the contract is made), or has a relevant turnover of less than $10,000,000 in the last income year preceding the contract’s formation.

If a company contravenes a relevant unfair-term related provision under the ACL, the maximum amount of pecuniary penalty allowed to be potentially imposed on the company by the legislation is currently as high as the greater of:

- $50,000,000;

- Three times the value of the benefit derived from the relevant contravention (when such value can be determined by a court);

- 30% of the company’s ‘adjusted turnover during the breach turnover period’ for the relevant contravention (when value of the benefit derived cannot be determined).

Importantly, the significant amendments to ACL mentioned above will also apply to existing contracts that have been renewed on or after 9 November 2023 with respect to conduct occurring at or subsequent to the time of renewal. For existing contracts that have been varied on or after 9 November 2023, any terms so varied or added will be governed by those amendments as well.

Regarding the determination of fairness, Section 24(1) of the ACL stipulates that:

A term of a consumer contract or small business contract is unfair if:

(a) it would cause a significant imbalance in the parties’ rights and obligations arising under the contract; and

(b) it is not reasonably necessary in order to protect the legitimate interests of the party who would be advantaged by the term; and

(c) it would cause detriment (whether financial or otherwise) to a party if it were to be applied or relied on.

A court is also required to take into account the contract as a whole as well as the degree of transparency of the disputed term when assessing fairness of terms within a consumer contract or small business contract.

If you are a consumer or small business owner concerned about potentially unfair terms affecting your interests, or if you represent a business that deal with small businesses or consumers and would like to minimize the risks associated with the contracts your business provides, please contact Nevile & Co today.

Disclaimer: This publication contains comments of a general and introductory nature only and is provided as an information service. It is not intended to be relied upon as, nor is it a substitute for specific professional legal advice. You should always speak to us and obtain legal advice before taking any action relating to matters raised in this publication.

By Morgan Collens

Planning for the future is crucial, especially when it comes to making decisions about your health and finances in the event of incapacity. Two key tools that help ensure your wishes are respected are Powers of Attorney and Advance Care Directives.

Powers of Attorney

An enduring power of attorney is a legal document that allows you to designate someone to make decisions on your behalf regarding personal matters (such as your living arrangements) and/or financial matters (such as managing bills). This designated person is referred to as your attorney. The “enduring” nature of this power means it remains in effect if you become unable to make decisions yourself.

- You have the option to limit the scope of the attorney’s authority to specific areas, and you can decide when their powers take effect.

- It’s important to note that your attorney cannot make medical treatment decisions for you unless they are also your designated medical treatment decision-maker.

- To create an enduring power of attorney, you must be at least 18 years old and capable of making informed decisions.

- Please remember, you can only create an enduring power of attorney for yourself, not for anyone else.

If you don’t appoint someone and are unable to make a decision when necessary, the Victorian Civil and Administrative Tribunal (VCAT) can assign a decision-maker for you, such as the Public Advocate or a trustee company.

Advance Care Directives

Creating an advance care directive is a way to plan for your future care in case you become unable to make decisions about your medical treatment.

An advance care directive is a legal document that allows you to:

-

- Record your values and preferences for medical treatment (known as a values directive)

- Make legally binding statements to health practitioners, specifying your consent to, or refusal of, certain future medical treatments (known as an instructional directive).

Caution: Only complete an instructional directive if you are certain about the medical treatments you want or don’t want in the future, as health practitioners are required to follow your instructions.

- An advance care directive is only used when you are no longer able to consent to or refuse medical treatment.

- Except in emergencies, health practitioners must obtain your consent before providing treatment.

- If you lose the ability to make medical treatment decisions, your health practitioner is required to make reasonable efforts to determine whether you have an advance care directive with relevant instructions. If such a directive exists, they will follow the instructions it contains.

- If you lack the capacity to make a medical treatment decision and have not created a relevant instructional directive, your health practitioner will consult your appointed medical treatment decision maker to make decisions on your behalf.

- The Medical Treatment Planning and Decisions Act outlines who qualifies as your medical treatment decision maker.

Your medical treatment decision maker is expected to make decisions based on what they reasonably believe you would choose. To do this, they must consider factors such as:

-

- Your values directive (if applicable)

- Any other values or preferences you have expressed.

Disclaimer: This publication contains comments of a general and introductory nature only and is provided as an information service. It is not intended to be relied upon as, nor is it a substitute for specific professional legal advice. You should always speak to us and obtain legal advice before taking any action relating to matters raised in this publication.

By Meng Cheong & Natalie Wang

Is Melbourne reducing the land tax threshold the only rule targeting property investors this time?

The Allan Labor Victorian government has made a big move, and this time the focus is on cracking down on short-term rentals. Not only might landlords need to be licensed, but they might also undergo an annual audit and pay a 7.5% short-term rental tax. This further squeezes landlord who are already dealing with high loan interest rates, potentially forcing them to sell their properties, increasing the housing supply, and putting downward pressure on property prices.

So, what exactly are the specific policies?

Currently, the second reading of the Short Stay Levy Bill 2024 (Vic) was moved on 28 August 2024 and is set to come into operation on 1 January 2025. The legislation introduces a 7.5% levy on short-stay accommodation bookings, including bookings made through platforms such as Airbnb and Stayz.

There are around 63,000¹ short-term rental properties in Victoria, with nearly half of these in regional Victoria. Almost 50,000 of those properties are entire homes that are not available for long-term rental.

The government aims to increase the compliance costs for short-term rental property investors and make Airbnb less profitable through taxation. This will pressure landlords to either abandon short-term rentals, switch to long-term rentals, or sell their properties to increase the availability of long-term rentals for local Australians, thus reducing the pressure on rising rents. The goal is to improve the lives of Melbourne residents, but for property investors, it could close off their income streams. The new rule has been announced as part of the landmark Housing Statement, the final policy has been informed by consultation with local councils, industry and tourism bodies to get the balance right for communities across Victoria.

The levy will not apply to a homeowner leasing out all or part of their principal place of residence for a short stay. When a homeowner goes on holiday and someone else stays there temporarily, the levy does not apply.

The government is also giving local communities the ability to respond to local concerns, with owners’ corporations now able to ban short stays in their developments if approved by 75 per cent of owners. Additionally, changes to the planning system will give local councils the power to regulate short-stay accommodation.

Another issue this may lead to is subleasing. If investors want to find an alternative to Airbnb, they might consider subleasing to maintain the relatively high rental income. While this may not be a concern for CBD apartments, it could be an issue for suburban houses. Owners will need to apply to the council if they are subleasing to more than three people, as this would classify the property as a ‘rooming house.’

Furthermore, we can speculate that along with the current trend, local governments may continue to squeeze the operating profit of short-term rentals and increase compliance costs. After the introduction of the licensing requirement, additional measures could follow, such as landlord training courses, commercial insurance, government inspections, etc.

Victoria property taxes today

Currently, Victoria has the highest property-related taxes in Australia. In 2023, the land tax threshold was lowered, resulting in higher taxes for property investors. This was followed by the foreign Absentee Owner Surcharge, and now, with this move targeting short-term rentals, property investors have more reasons to be concerned.

While there is no precedent in Australia, recent laws against Airbnb in New York have sparked some public discussions. The investment portfolio for real estate investors may need to be updated, with long-term capital gains and long-term rentals perhaps being more favourable in light of the new fiscal approach.

¹https://www.premier.vic.gov.au/more-long-term-rentals-and-more-social-homes

Disclaimer: This publication contains comments of a general and introductory nature only and is provided as an information service. It is not intended to be relied upon as, nor is it a substitute for specific professional legal advice. You should always speak to us and obtain legal advice before taking any action relating to matters raised in this publication.

By Tracy Collins & Morgan Collens

Having a Will is essential for ensuring that your estate is distributed according to your wishes after your death. It is equally important to regularly update your Will to reflect any changes in your circumstances and/or intentions.

Legal Requirements for Updating a Will

Under the Wills Act 1997 (Vic), a Will can be altered through a codicil (a document that amends rather than replaces a previously executed Will) or by creating a new Will. Both methods require the same formalities as the original Will: the document must be in writing, signed by the person making the Will, and witnessed by two individuals who are not beneficiaries.

Life Changes Necessitating an Update

Several life events may necessitate updating your Will:

- Marriage or Divorce: In Victoria, marriage revokes a Will unless it is made in contemplation of that marriage. Conversely, divorce does not automatically revoke a Will but can affect the distribution of your estate, particularly regarding any bequests to a former spouse.

- Birth of Children or Grandchildren: The arrival of new family members is a significant reason to update your Will to ensure they are included as beneficiaries.

- Significant Financial Changes: Acquiring or disposing of substantial assets should be reflected in your Will to ensure your current financial situation is accurately represented, particularly if you have gifted specific assets to specific beneficiaries.

- Changes in Relationships: Alterations in your personal relationships, such as the dissolution of friendships or the death of a beneficiary, require corresponding adjustments in your Will.

Risks of an Outdated Will

Failing to update your Will can lead to unintended consequences, such as:

- Disputes Among Beneficiaries: An outdated Will can lead to conflicts among beneficiaries, potentially resulting in costly legal disputes and strained family relationships.

- Unintended Beneficiaries: Without updates, assets might go to individuals you no longer wish to benefit, while those you intend to provided for may be overlooked.

Practical Steps for Keeping your Will Updated

- Regular Reviews: It is good practice to review your estate planning from time to time, particularly when your circumstances change. We recommend reviewing your documents every three years.

- Clear Documentation: Keep a record of any amendments or new Wills, and inform your executor and close family members of the location of these documents.

If you are concerned about your estate planning arrangements, contact Nevile & Co today!

Disclaimer: This publication contains comments of a general and introductory nature only and is provided as an information service. It is not intended to be relied upon as, nor is it a substitute for specific professional legal advice. You should always speak to us and obtain legal advice before taking any action relating to matters raised in this publication.

By Morgan Collens

Junior Lawyers aren’t really assessed on their technical ability. It’s important, but it’s usually something that law firms expect to be developed over time. Here are five things that may be more important for junior lawyers to focus on instead:

Develop Strong Research Skills

Effective legal research is a critical skill for junior lawyers. Improving your research skills can make a significant difference in the quality of your work. To enhance your research abilities:

- Familiarize yourself with the various legal research databases and tools used by your firm.

- Practice efficient keyword searching to find relevant case law, statutes, and secondary sources quickly.

- Stay updated on recent legal developments in your practice area by regularly reading legal journals and news.

Manage Your Time Effectively

Time management is crucial in the legal profession where deadlines are often tight.

To manage your time effectively:

- Use a planner or digital calendar to track deadlines and important dates.

- Break down large projects into smaller, manageable tasks and prioritize them.

- Allocate specific time slots for focused work and minimise distractions during this period.

Build Professional Relationships

Networking and building professional relationships are vital for career growth. To cultivate strong professional connections:

- Attend industry events, seminars, and conferences to meet other legal professionals.

- Seek out mentorship opportunities within your firm or through professional associations.

- Engage with colleagues and superiors by participating in firm activities and social events.

Enhance Your Writing Skills

Clear and concise legal writing is essential for drafting documents and communicating with clients. To improve your writing skills:

- Take advantage of any writing workshops or training sessions offered by your firm.

- Review and analyse high-quality legal documents to understand effective writing techniques.

- Practice writing regularly and seek feedback from supervisors to refine your style and accuracy.

Stay Organised

Keeping your work organized ensures efficiency and reduces stress. To maintain organization:

- Create a filing system for both physical and digital documents.

- Keep detailed notes on your tasks and progress to avoid missing important details.

- Regularly review and clean up your workspace to maintain a productive environment.

By focusing on these additional areas, junior lawyers can further enhance their effectiveness and establish a strong foundation for their legal careers.

Disclaimer: This publication contains comments of a general and introductory nature only and is provided as an information service. It is not intended to be relied upon as, nor is it a substitute for specific professional legal advice. You should always speak to us and obtain legal advice before taking any action relating to matters raised in this publication.

By Jack Nevile

What is VLRT?

The Victorian Government is broke and needs money. Every announcement from the State for the foreseeable future should be seen through this lens, at least until politicians decide to stop wasting your money, or hell freezes over. Consider investing in a good jacket.

How does a government get the most feathers from the duck, with the least amount of quack? Remember, politicians don’t want to lose voters but desperately need to take their money. The tried-and-true method is starting with politically popular taxes. They’ve announced a swathe of fees for foreigners, businesses, and landlords, the usual easy targets. But another type has also arisen – the landbanker. This term creates a fantastic scapegoat – they’re hoarding precious land which should be ours! – and nobody is going to write long newspaper articles crying for a wunch of bankers, after all.

Vacant Residential Property Tax is a tax on any property in Victoria which was vacant for more than 6 months in the calendar year. It is levied at 1% of the Capital Improved Value (the value shown on your rates notice – usually the market value minus ~10%) for the first year, and increases by 1% each subsequent year, up to a maximum of 3% per year.

The main ways to avoid the tax are:

- Live in the property yourself;

- Rent out the property under a Lease or bona fide short-term letting arrangement, and the property was actually occupied for 6+ months;

- Transact the property, i.e. sell, or have bought it in that calendar year;

- The house is a holiday home used by either you or your relatives for 4+ weeks of the year; or

- The land has been uninhabitable for under 2 years.

Surely it’s not a big deal. How many empty houses can there possibly be?

It is a big deal. And don’t call me Shirley. According to Prosper, 1.5% of property in Melbourne is completely empty, and about 5% are usually empty, if you calculate based on water consumption. If you go for a long walk around your neighbourhood you will probably see heaps. My guess is the real number of completely empty properties is far above 2% – leaky taps don’t pay rent. Prosper’s report is here:

What VLRT means for you

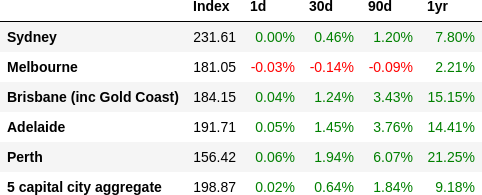

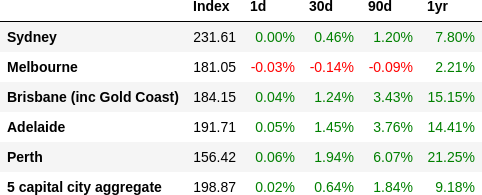

Combined with other new taxes, many property investors are abandoning the good ship, Victoria. Just look at the national house price indices:

(h/t to @rabbit_wealth on Twitter)

People who may have otherwise held their property in the hope of capital appreciation are selling, so much more supply is available than usual.

If you’re a renter this is good news – empty/abandoned property should start to hit the market. In my own neighbourhood I notice empty properties – an unfortunate side effect of doing squatters rights law – and some of them have suddenly been spruced up and are now for rent at exorbitant prices. More property for rent means lower prices.

If you’re an enterprising renter this is even better news – you may know of an abandoned property somewhere you want to live, and you may also know the VLRT on an empty $1,000,000 house is $10,000 a year. Better you live in it for cheap rent, than it staying empty and the owner pays the government. You don’t have to deal with an agent, the landlord gets a tax break, and you get a home.

Speaking of, first homebuyers are seeing big wins – the government is splashing out money in the form of 25% equity loans with 0% interest, and prices are dropping. Some of my first home buyer clients are buying simply because the mortgage on the other 75% is cheaper than renting the same house.

My final thoughts

If you’re lucky enough to have an empty property lying around, it’s time to do something about it before January 1 when the tax hits. Call our office on (03) 9664 4700, or send me an email at jack.nevile@nevile.com.au.

Disclaimer: This publication contains comments of a general and introductory nature only and is provided as an information service. It is not intended to be relied upon as, nor is it a substitute for specific professional legal advice. You should always speak to us and obtain legal advice before taking any action relating to matters raised in this publication.

By Morgan Collens

Your Guide to Buying a Home

Navigating the intricacies of property ownership can be daunting, especially when it comes to the legalities of transferring ownership. This is where conveyancing steps in, providing crucial assistance to buyers in the complex settlement process of purchasing a new home.

What is Conveyancing?

Conveyancing is the legal realm concerned with the transfer of real property ownership. It involves the transition of ownership from one party to another.

For sellers, also known as vendors, this entails disclosing pertinent information to potential buyers through documents like the Section 32 Statement.

Why do you need a Conveyancer?

Having a conveyancer by your side is essential due to the intricate paperwork involved, often laden with legal jargon and technical terms.

When purchasing, your conveyancer will meticulously review contracts and disclosure statements, ensuring you understand the terms and conditions, as well as guiding you through the necessary due diligence.

What does a Conveyancer do?

A conveyancer shoulders the responsibility of facilitating the transfer of property title, advising on legal matters, and handling paperwork, allowing you to focus on the practicalities of moving. They navigate complex legal requirements on your behalf, such as adjustment calculations and changing tax laws, alleviating the stress of the process.

What to Expect from your Conveyancer

Your conveyancer handles all aspects of the ownership transfer process, from preparing legal documents to liaising with relevant parties, including banks, sellers, and estate agents. For sellers, they manage document preparation, mortgage discharge, and fund disbursement, ensuring a smooth transaction.

Settlement Day and Beyond

On settlement day, your conveyancer oversees the transaction, ensuring a seamless exchange of keys and completion of financial adjustments. Post-settlement, they handle final paperwork and liaise with local authorities regarding ownership changes, offering ongoing support as needed.

In the intricate landscape of property transactions, a conveyancer is your trusted guide, simplifying the process and safeguarding your interests every step of the way.

Disclaimer: This publication contains comments of a general and introductory nature only and is provided as an information service. It is not intended to be relied upon as, nor is it a substitute for specific professional legal advice. You should always speak to us and obtain legal advice before taking any action relating to matters raised in this publication.

By Jack Nevile & Anna-Nikol Tanti

Victoria is the place to be – taxed. The government has unveiled a host of new property taxes over recent years. Property is a great way for governments to raise revenue because there is no escape – owners can’t pick up the land and take it elsewhere. The only way out is to sell and pay the tax upon settlement. And if you decide not to pay, don’t worry – they’ll sell it for you.

Any increased cost of owning property is factored into the current price. While slightly up, Victorian prices have actually fallen over the past few years after adjusting for inflation. In plain English, this means that your house which was worth 10,000 trips to the supermarket a few years ago may only be worth 8,000 trips now. This is good news for first home buyers, who are seeing the benefit of rising wages, falling prices, and generous government handouts.

These falling prices contrast dramatically to other states which don’t have these taxes. The figures below depict 12 months of price changes of Australian property in certain cities. Notice the odd man out?

(h/t to @rabbit_wealth on Twitter)

So what are the taxes that property owners need to be aware of? We’ve simplified them below.

One-off taxes

Stamp Duty

Stamp duty is 5.5% of the purchase price. Victorian stamp duty is very high in comparison to other states as the reductions/exemptions cap is at a very low level – only $750,000, which hardly buys anything in the metro area these days.

If you’re a foreign purchaser, you must pay Foreign Purchaser Additional Duty. This is an additional 8% stamp duty. A foreign purchaser is not an Australian citizen or a Permanent Resident, or New Zealand citizen present in Australia at settlement.

Windfall Gains Tax

Windfall gains tax applies to the rezoning of land that increases the value by more than $100,000. It is taxed at 50% of the capital gain. An exemption exists for residential property.

Metropolitan Planning Levy

This tax is payable if the estimated cost of a development in metropolitan Melbourne exceeds $1,207,000. The levy is $1.30 for every $1,000 of the estimated development costs. It is paid as part of your planning permit application.

Growth Areas Infrastructure Contribution

This tax is paid upon the purchase or development of a large piece of land within a growth-zoned area. Usually this is paid by the developers, who then pass it onto individual buyers in their sale prices.

FIRB

The Foreign Investment Review Board charges $42,300 per million dollars or part thereof on the purchase price, for any foreigners looking to buy established Australian property. There is a significant discount for new property.

Taxes Payable Annually

Land Tax

Land tax is based on the total taxable value of all the land you own in Victoria, excluding exempt land. Exempt land includes land such as your home. Land tax is payable on investment properties, commercial properties and vacant land.

COVID Debt Repayment Plan

This is a “temporary” 10-year change to land tax. For people holding land valued between $50k and $100k, a $500 tax is payable. Between $100k and $300k, $975 is payable. For land holdings above $300k, $975 is payable plus an increase of 0.1% above standard land tax.

Commercial and Industrial Property Tax

This tax is for commercial and industrial properties and is a transition scheme away from stamp duty. It is levied at 1% of the land value.

Absentee Owner Surcharge

The absentee owner surcharge is a 4% tax on the value of all land in Victoria owned by an absentee owner. It is very expensive for land, and expensive on apartments.

An absentee owner is an individual that:

-

- Is not an Australian citizen or permanent resident;

- Does not ordinarily reside in Australia;

- Was absent from Australia on 31 December 2023 for the purpose of the 2024 land tax assessment; and

- Was absent for more than 6 months throughout 2023.

Vacancy Fee Return for Foreign Owners

Foreign Owners must lodge vacancy fee returns every year. If the property is not occupied or genuinely available for rent, you will be required to pay the current FIRB fee. You must lodge a Vacancy Fee Return even if the property is not vacant. You will be receiving email reminders about this every year.

Vacant Residential Land Tax

Homes that are vacant for more than 6 months per year are taxed at 1% of thier capital improved value, paid in addition to your land tax. This increases to 2% in the second year it remains vacant, and 3% in the third, where it stops.

Council Rates

Council rates are a property tax used to fund community infrastructure and services. It is calculated by multiplying the value of the property by the rate in the dollar. The rate in the dollar is set by each council.

Fire Service Property Levy

This levy is used to fund Victoria’s fire and emergency services. It is paid annually and includes both a fixed and variable rate. The fixed charge for 2024 (including vacant land) is $132 for residential and $267 for non-residential land. The variable rate depends on the capital improvement value of the land and the land use classification.

When will the property taxes stop coming?

Australians love property – bidding the prices up to astronomical heights is our national obsession. Governments love spending money, and they tax where the money is. At some point, these two opposing forces are going to collide. Victoria is simply the canary in the coal mine.

Disclaimer: This publication contains comments of a general and introductory nature only and is provided as an information service. It is not intended to be relied upon as, nor is it a substitute for specific professional legal advice. You should always speak to us and obtain legal advice before taking any action relating to matters raised in this publication.

By Tracy Collins & Morgan Collens

The concept of testamentary freedom in Australia has a rich historical background deeply rooted in English common law traditions. Testamentary freedom refers to an individual’s right to dispose of their property upon death according to their own wishes, as expressed in their Will, without interference from external parties.

Australia inherited its legal system from England, and the principle of testamentary freedom was established early on. During the colonial period, Australian courts primarily followed English common law principles, including those relating to Wills & Estates. Throughout the 19th and early 20th centuries, testamentary freedom was largely unchallenged in Australia. Testators had broad discretion in deciding how to distribute their assets, including the ability to disinherit family members or leave their estate to charitable organizations.

However, over time, societal attitudes towards family obligations and the distribution of wealth began to shift. This led to increasing calls for reforms to the law of succession to ensure fair and adequate provision for family members and dependents, especially in cases where they were left without adequate support.

In response to these concerns, Australian states and territories began to enact legislation to provide for family provision claims, which allowed certain eligible individuals to challenge the terms of a Will if they believed they had not been adequately provided for by the deceased. These laws introduce limitations on testamentary freedom by enabling courts to intervene and make orders for provision from the deceased’s estate to eligible claimants.

Despite these developments, testamentary freedom remains a fundamental principle of Australian succession law. While the law now recognizes the importance of providing for family members and dependents, individuals still generally have significant autonomy in determining how their assets will be distributed upon their death. However, this autonomy is subject to certain legal constraints and the possibility of family provision claims, which aim to strike a balance between testamentary freedom and the protection of vulnerable beneficiaries.

Disclaimer: This publication contains comments of a general and introductory nature only and is provided as an information service. It is not intended to be relied upon as, nor is it a substitute for specific professional legal advice. You should always speak to us and obtain legal advice before taking any action relating to matters raised in this publication.

By Morgan Collens

Settlement marks the culmination of your property purchase journey, where the culmination of financial transactions and legal processes brings you one step closer to homeownership. Here is what to anticipate on this pivotal day.

Duration of Settlement

Typically spanning 30 to 90 days, the settlement period is mutually agreed upon by both parties and specified in the contract of sale. This timeframe allows for the fulfillment of financial and contractual obligations and facilitates logistical arrangements for moving.

Key Players

Settlement involves financial representatives (banks or lenders) and legal representatives (conveyancers or solicitors) representing both parties. Conveyancers play a vital role throughout the process, overseeing checks, searches, signings, and certifications essential for a smooth transition.

Property Inspection

Consumer Affairs Victoria stipulates the buyer’s entitlement to inspect the property before settlement. Coordination with the estate agent ensures a final inspection to verify the property’s condition. For new homes, engaging a building inspector is advisable to ensure compliance with building codes.

Financial Transactions

On settlement day, the buyer disburses the balance of the purchase price to the vendor. Conveyancers coordinate with banks to facilitate the transfer, ensuring a seamless financial transaction. Additionally, payment of land transfer duty (stamp duty) and lenders mortgage insurance is settled electronically.

Legal Formalities

Your conveyancer manages the preparation and submission of all legal documents required for property transfer. Once signed by both parties, these documents are sent to the titles office for registration, confirming your ownership. Any outstanding fees are settled to ensure a smooth transition of ownership.

Notification Processes

Following settlement, a Notice of Acquisition is dispatched to relevant authorities, notifying them of the property’s change of ownership. Your conveyancer ensures compliance with legal obligations, including notifying water authorities, local councils, and other pertinent entities.

Settlement Date Adjustments

Any changes to the settlement date require mutual agreement between buyer and seller. While extensions are permissible, penalty interest may be incurred. It’s crucial to adhere to contractual terms to avoid complications.

Additional Considerations

Arrange insurance and utility connections ahead of settlement day to facilitate a seamless transition. Contacting preferred suppliers ensures timely connection of essential services, streamlining your move into the new property.

Disclaimer: This publication contains comments of a general and introductory nature only and is provided as an information service. It is not intended to be relied upon as, nor is it a substitute for specific professional legal advice. You should always speak to us and obtain legal advice before taking any action relating to matters raised in this publication.